Think Twice About Chasing The Biggest Stocks

I get it. Investing can seem so easy. The 10 biggest stocks in the S&P 500 are the best ones. By far. Why shouldn’t I just own those stocks and only those stocks? Why should I bother with Diversification?(maybe they’re correct, those who call it Deworseification – they’re not, or at least they’re not giving you the whole picture, not being open about the advantages they have that you don’t - but good word, right?). Can’t I just own Nvdia / Microsoft / Apple / Alphabet / Amazon / Meta / Berkshire Hathaway / Broadcom / Eli Lilly / Tesla, lean back, and get rich.

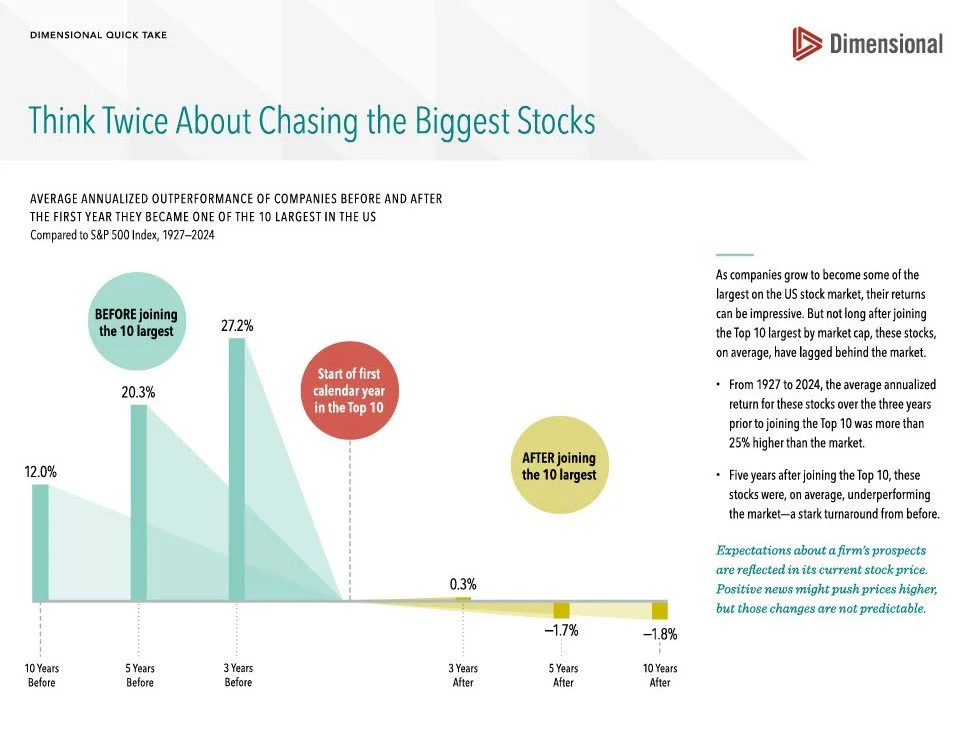

Unfortunately. it’s not that easy. At least it hasn’t been so far (in the past 100 years). Look at the graphic above. [F.1] It displays the average yearly outperformance of companies that, at one time, were among the 10 largest in the US (T10). It shows their outperformance during different periods – first, the period before they became one of the T10 and then the period after they became one of the T10.

Before we dive into what the chart shows, let’s talk first for a minute about what we mean when we say “yearly outperformance”. In this case, yearly outperformance refers to the average annual performance of the T10 vs. the average annual performance of the (total) US Stock Market. So, if, in a given year, the T10 averaged a 15% return and the US Stock Market, as a whole, returned 10% that year, then the average outperformance that year of the T10 was 5%. [F.2] Outperformance can occur in down years as well. If, in a given year, the US Stock Market is down 18%, but the T10 are down an average of 10%, then the average outperformance that year is 8%. In a year like that, they would have outperformed even though they lost money. This is what the chart is showing, not how the T10 did in absolute terms, but how they did compared to how the entire US Stock Market did.

And so, how did they do? In the years prior to joining the T10, these stocks hugely outperformed the broader US market. In the 10 year period prior, these stocks outperformed the broader US stock market by about 12% per year. It gets better. In the 5 year period prior to joining the T10, they outperformed by 20% per year. And just before officially becoming one of the 10 largest companies in the US, during the 3 year period prior, these “soon-to-be-huge” companies outperformed the broader US stock market by an average of more than 27% per year! Keep in mind that since the US stock market has produced an average return of around 10% per year, this means that means that the average “soon-to-be-huge” company returned around 37% per year in *each* of the 3 years before cracking the Top 10.

But what about after? What happens then? In the 3 years after becoming one of the 10 largest US companies, outperformance drops to just 0.3% per year, on average. So these stocks do continue to outperform, just not by much. But it gets worse. In the 5 years after becoming T10, the average stock of one of these companies underperforms by about 1.7% per year and during the 10 year period after T10 entry, its share price lags the broader market by, on average, 1.8% per year. Now this doesn’t mean you necessarily lose money by investing in these companies once they’re already large, just that you make less than you would have, had you just owned a diversified portfolio consisting of all US stocks.

So that’s what the data says. But why? [F.3]

Here’s some guesses. Like all goods and services, the price of a company’s stock is determined (or discovered, depending on how econ you want to be about it) by the interaction of supply and demand forces. So let’s examine from that vantage point.

I can think of a number of possible reasons why the demand for a company’s stock might decline after the company grows large. The company might get worse. It might get bloated, hiring unnecessary layers of management that don’t contribute to revenue. It might expand too quickly into new products or geographic markets where it lacks the same expertise as in its home product or market. It might respond poorly to new competitors. Or management might just get more risk-averse. At this point, after a decade or more of outperformance, it’s likely that board members and senior management have a large portion of their personal wealth tied up in the company’s shares. This affects decision-making. Even subconsciously, the goal might become more about keeping the stock price from falling than making it grow. Or the company, through no fault of its own, might fall prey to the Law of Large Numbers. It’s just harder to earn a 20% return on $100B than it is on $100M. [F.4] When a company gets to a certain size, it’s fair for investors to start questioning how they’ll maintain their growth rates. And even if the company does everything right, stays lean, stays focused, keeps hitting growth targets, fund managers might just move on, either because new companies/industries become fashionable, or they’re seeking to distinguish themselves from the herd by finding the next “soon-to-be-Top-10” company. [F.5] Or fund managers may be running up against their own risk management targets. [F.6]

So those are some possibilities why demand may slow when a company gets to T10. Now, let’s look at the other side. Why might the supply of a company’s stock increase after becoming a T10? At this point, the company is huge and a large portion of the net worth of senior executives and early employees/investors is likely tied up in that company’s stock. They may decide to sell (or need to sell) to fund their lifestyles. Or maybe they just feel (or are counseled) it would be prudent to diversify. Or maybe they just want to splash out. Whatever the case, a large wave of selling from top shareholders could increase the shares on the market and depress prices. It’s also possible the companies themselves contribute to a supply increase by issuing new shares, choosing to fund expansionary activities through new issuances, capitalizing on high stock prices rather than adding liabilities to the balance sheet. And I doubt this one’s a needle-mover, but I’d be curious to find out if philanthropic gifts of appreciated stock are over-represented by T10 stocks, particularly those that have recently joined the T10. If any of you are looking for a research topic, have at it.

Does that explain it? Possibly. It might partly tell the story. But the above reasons can be countered. For one, maybe this time *really is* different. Maybe this time, all you really need to do is load up on the T10 and sit back. But why? Well, this time might be different because there’s never been this much money passively flowing into the major indices before, month after month, from paychecks to 401K accounts to some fund that then buys the index, disproportionately propping up the largest companies. [F.7] Another counter - we’ve never had Top 10 Companies like *these* (at this writing, in the fall of 2025, no one’s losing sleep over Nvidia’s order book).

But of course there are counters to the counters (what do people think about “countertops”? Maybe we can make it a thing). The main, most obvious countertop is that this time is *never* different. Specifically, in the sense of “No, this time isn’t different” - what if we’re at Peak Passive? What if AI eats all the white collar jobs and there’s less monthly 401K flows to prop up the largest companies? (I doubt it, but it’s possible). And there are many other countertops - what if the ”E” in PE doesn’t materialize? What if the $20/month ChatGPT subscription doesn’t cover the *trillions* in CapEx? Other warning signs – funny little GPU depreciation accounting games; potentially worrisome circular vendor financing arrangements; true risks hiding in black box SPVs. But there are better essays you can read about these things, if it’s of interest.

Let’s end here. I don’t have much of a takeaway for you other than just look at the data. If you invest in the big companies before they get big, you’ll do amazingly well, but if you wait until they’re already at the top, you’ll likely underperform. At least that’s how it’s gone up until now. But is this time different? That’s the question for today, in late 2025, right? [F.8] I don’t really know if this time is different, but my instinct is that it isn’t. And it’s probably not different precisely because it *feels* like it really is, it feels like these particular T10 Companies are somehow better and more invincible than past T10 Companies. And maybe they are, I really can’t poke holes in any of their business models or future prospects without what feels like really reaching. They’re solid. They print money. But in a more general sense, stepping back from this particular moment, an investment strategy of simply looking at who are the biggest companies at this moment and investing in them *now* feels way too easy, and that’s not how this tends to work. Outperformance is hard. It should be hard. If you’re consistently outperforming, that’s the same as saying that you’re consistently doing better than lots and lots of really smart, highly ambitious, well-resourced people. And that’s hard to do. Nvidia, Meta, Apple, Microsoft, Berkshire – very important, very impressive. But still. Be careful.

And if you’re still here and interested in having a conversation about maybe becoming a client of Berkshire Wealth Group, click HERE to schedule a free, no-obligation Introductory call. Looking forward to meeting you!

1 Not super relevant, but I debated cutting that 1st paragraph after I noticed that the data in this chart came from the Fama-French database – Dr. Fama is known for beginning presentations by saying “Look at Figure 1”. No “I’m so happy you’re all here” or “Funny Anecdote”. No throat clearing whatsoever. Just “Look at Figure 1”.

2 To calculate the average outperformance of the T10, you take the sum of the outperformance of each company in the T10 and then divide by 10

3 You could claim that the why is irrelevant. The data says what the data says and your investment decisions should be based on that alone. The value in knowing why is only that, if you know why something is happening, you’ll be able to anticipate when that thing is going to stop happening and adjust your behavior accordingly. I don’t want this to descend into an active vs. passive debate (which is where I can feel this headed), so I’ll leave it at “I’ll give some maybe reasons why because it’s more interesting reading”

4 Our best entrepreneurs would debate this, but I think it’s a valid assumption for most

5 You could argue that these fund managers will be replaced by others, specifically the performance chasers. And that may be true. But the performance chasers are likely to have weaker stomachs and contribute to pullbacks becoming corrections, furthering underperformance.

6 Remember, for the stock price to keep going up, there needs to be new money flowing into the stock. If I’m managing a fund that has a 5% maximum allocation to any one stock (in its charter), no matter how much I like a particular company and no matter how bullish I am on its growth prospects, once 5% of my fund is invested in that stock, I can buy no more

7 Is it possible that the Against Stock Picking crowd won the argument so fully that they ended up creating an environment where the thing to do is to actually Pick Stocks (the big ones)? Did their fundamental argument, “it’s way too hard to pick stocks against the professionals, just buy the index” ultimately lead to Actually Just Buy The Biggest Stocks In The Index (since everyone else is buying the market-weighted index, this leads to more and more gains for the largest stocks, since the index is heavily weighted in their direction). Another research topic might be to see how changes in passive investing behavior affected the stock prices of the most heavily weighted companies in any market weighted index vs other companies in that index.

8 or early 2050, or whenever you’re reading this

DISCLOSURE: The information contained in this essay does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources consdierted to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be sutiable for all investors.