529 Plans: Building an Educational Legacy

As we approach year-end and the holiday season, many of our clients are thinking about meaningful gifts for children and grandchildren. This year, there's an especially compelling case for considering 529 plans—not just as a thoughtful gift, but as a strategic financial move enhanced by recent legislative changes.

The gift tax exclusion has increased to $19,000 per person for 2025 (up from $18,000 in 2024), and the SECURE 2.0 Act has fundamentally transformed how 529 plans work. Starting in 2024, beneficiaries can now roll over a lifetime amount up to $35,000 from a 529 plan into a Roth IRA, eliminating one of the biggest historical concerns: what happens if the money isn't needed for education?

Additionally, distributions from grandparent-owned 529 plans no longer impact a student's eligibility for financial aid starting with the 2024-2025 academic year—a change that makes these plans particularly attractive for grandparents looking to support their grandchildren's education without inadvertently reducing their access to need-based assistance.

For many families, education represents one of their most important values. Yet when it comes to funding that education, we often see a disconnect between intention and action. Parents want to support their children's or grandchildren's educational journeys, but without a clear strategy, those dreams can become a source of financial stress rather than fulfillment.

Enter the 529 plan: a powerful yet often underutilized tool that can help you align your financial resources with your values around education and family legacy.

Understanding 529 Plans

A 529 plan is a tax-advantaged savings account specifically designed for educational expenses. Named after Section 529 of the Internal Revenue Code, these plans come in two main varieties: prepaid tuition plans and education savings plans. Most families work with education savings plans, which allow investments to grow tax-free when used for qualified educational expenses.

The Hidden Cost of Waiting

Many parents tell themselves they'll start saving "when things settle down" or "after the next promotion." But the cost of delay is real. Consider this: a child born today will likely face college costs of over $200,000 for a four-year degree at a public university, and potentially double that at a private institution. Without a strategic savings plan, families may find themselves either taking on significant debt or making difficult compromises when the time comes.

The question isn't whether you can afford to save. It's whether you can afford not to.

The Benefits of 529 Plans

Tax Advantages That Compound Over Time

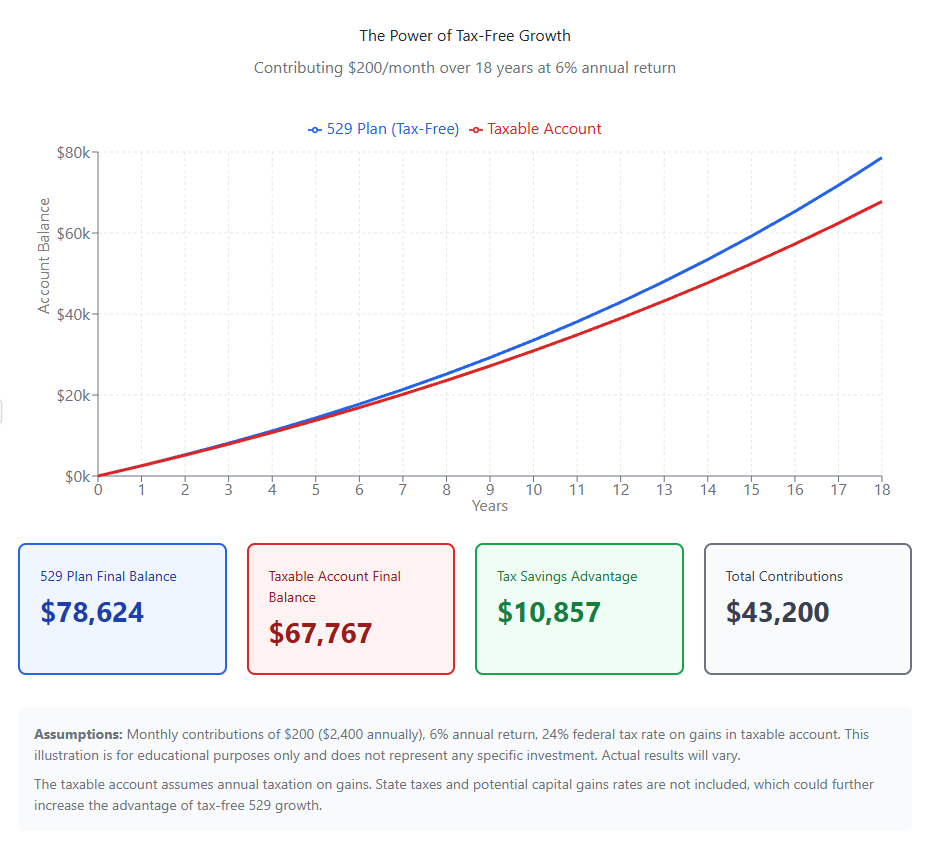

Your contributions grow federal tax-free, and withdrawals for qualified educational expenses are also tax-free. Many states offer additional tax deductions or credits for contributions. This triple tax advantage can significantly amplify your savings over time.

This content was created with the assistance of artificial intelligence (AI). While efforts have been made to ensure the quality and reliability of the content, it is important to note that AI-generated content may not always reflect the most current developments or nuanced human perspectives.

Flexibility Beyond Traditional College

Modern 529 plans aren't just for four-year universities. Qualified expenses now include:

Vocational and trade schools

Apprenticeship programs

Up to $20,000 in K-12 tuition per year

Student loan repayment (up to $10,000 lifetime)

This flexibility ensures that your savings can align with your child's unique path, whatever that may be.

Control and Legacy Building

Unlike custodial accounts, you maintain control of a 529 plan. You decide when and how the funds are distributed. If one beneficiary doesn't need the full amount, you can transfer it to another family member, creating a multi-generational education fund that becomes part of your family legacy.

Estate Planning Benefits

For grandparents and high-net-worth individuals, 529 plans offer additional estate planning advantages. You can contribute up to five years' worth of annual gift tax exclusions upfront (currently $95,000 per beneficiary for 2025, or $190,000 for married couples) without triggering gift tax consequences. This "superfunding" strategy allows you to move substantial assets out of your estate while maintaining some control over how they're used.

The Grandparent Advantage

A significant 2024 change eliminated the "grandparent penalty." Previously, distributions from grandparent-owned 529 plans could reduce a student's financial aid eligibility by up to 50% of the distribution amount. Now, these distributions are no longer counted as student income on the FAFSA, making grandparent-funded 529 plans an even more powerful tool for supporting grandchildren's education.

Steps to Implement Your 529 Strategy

1. Calculate Your Education Funding Goal

Be realistic about what you want to provide. Some families aim to cover full costs, while others prefer to fund a portion and have their children contribute through work or loans. There's no single right answer, but clarity helps you plan effectively.

2. Choose the Right Plan

You're not limited to your state's plan, though your state may offer tax benefits for using it. Compare investment options, fees, and performance across plans. Look for low-cost index fund options and age-based portfolios that automatically adjust risk as your beneficiary approaches college age.

3. Automate Your Contributions

Set up automatic monthly contributions that align with your budget. Even modest amounts can grow significantly over time. Starting with $200 monthly when a child is born and earning a 6% return could result in over $80,000 by age 18.

4. Leverage Family Contributions

Share your child's 529 plan information with grandparents and other family members. Many plans offer gifting platforms that allow relatives to contribute for birthdays and holidays, creating meaningful presents that compound over time. With year-end approaching, a 529 contribution can be a tax-smart gift that far outlasts any toy or gadget.

5. Review and Adjust Annually

As your financial situation evolves and your child gets closer to college age, review your strategy. Adjusting your asset allocation can protect gains and help ensure you're on track to meet your goals.

Overcoming Common Concerns

"What if my child doesn't go to college?" With the new SECURE 2.0 provisions, a lifetime amount up to $35,000 can be rolled over to a Roth IRA for the beneficiary (subject to annual contribution limits and certain requirements). Combined with expanded qualified expenses and the ability to change beneficiaries, unused funds are rarely a problem. You can even roll over funds to a Roth IRA for the beneficiary under certain conditions, providing a retirement head start. Certain changes in beneficiary may result in a taxable event.

"What about financial aid?" While 529 plans are considered in financial aid calculations, parent-owned plans have minimal impact on aid eligibility. The benefits of tax-free growth typically far outweigh any potential reduction in aid.

"The investment options seem limited." While you can't pick individual stocks, most plans offer diverse, low-cost portfolios managed by reputable firms. For most families, this simplicity is actually a benefit.

The Rewards of Strategic Education Funding

When you commit to funding education through a 529 plan, you're likely to experience:

Confidence knowing you're building a foundation for your child's future

Greater flexibility in college choices, unconstrained by cost alone

Tax savings that compound meaningfully over time

The satisfaction of creating educational opportunities across generations

A tangible expression of your values around education and family

Conclusion

Education funding doesn't have to be a source of anxiety or last-minute scrambling. By implementing a 529 strategy that aligns with your values and goals, you can transform education expenses from a potential burden into an intentional investment in your family's future.

As we approach the end of 2025, there's never been a better time to revisit your education funding strategy. The increased gift tax limits, expanded flexibility under SECURE 2.0, and elimination of the grandparent penalty make 529 plans more attractive than ever. Whether you're looking to make a meaningful year-end gift or simply want to ensure your family's educational legacy is secure, now is the time to act.

The best time to start was yesterday. The second-best time is today.

If education matters to you, your 529 plan should be more than an afterthought. It should be a central component of your family's financial strategy. Consider reviewing your current approach and asking yourself: does my education funding strategy reflect the priority I place on learning and opportunity?

Your children's future – and the legacy you create – will reflect the decisions you make today.

529 plans come with fees and expenses, and there is a risk they may lose money or underperform. Most states offer their own 529 programs, which may provide benefits exclusively for their residents. Please consider whether the state plan offers any tax or other benefits. Tax implications can vary significantly from state to state.

State tax treatment of K–12 withdrawals is determined by the state(s) where the taxpayer files state income tax. Please consult with a tax advisor for further guidance.

Any hypothetical examples are for illustration purposes only. Actual investor results will vary.